E7.1: The Urgent Need for Affordable Real-Time Proof of Reserves

Where We Are Since the 2014 Blog Post and Where we Need to be.

In the wake of major platform collapses like FTX, trust in crypto has been severely shaken. These events have highlighted a critical question (which is in a sense also applicable to TradFi): How can we be sure that companies actually hold the assets they claim? This is where Proof of Reserves (PoR) comes in, and why it's becoming increasingly crucial in the crypto industry.

What is Proof of Reserves?

POR is a method for companies to demonstrate that they have enough assets to cover what they owe to their customers. Around 2022, the concept came to crypto as a way to verify that for every digital coin or token a company has issued or is holding for its users, there's an equivalent amount of real assets backing it up.

The Current State of Proof of Reserves

Currently, most major players in the crypto world, either just claim their backing or provide POR reports infrequently. For example, popular stablecoins like Tether only provide POR reports quarterly. These reports are typically attestations (evidence or proof of something) verified by third-party firms, offering a snapshot of the company's reserves at a specific moment in time.

The Tether Example

Tether is a stable coin that should always be worth one US dollar. Despite claiming billions in excess reserves, Tether has faced criticism for the lack of detail and independent verification in its quarterly reports. This infrequent reporting leaves users in the dark about the true state of reserves for months at a time, creating significant risk in a market that moves quickly.

The Need for Real-Time Verification

Reports are better than just claims. However, a quarterly frequency is simply not enough. The crypto market operates 24/7, with millions of transactions happening every day. The market needs real-time Proof of Reserves. Real Time POR could offer:

Instant verification of asset backing

Early detection of potential issues, possibly preventing major collapses

A stronger foundation for the growth of decentralized finance

Increased transparency and trust in the whole crypto ecosystem

Current Solutions and Challenges

There are a few existing solutions in the market working on real-time POR. These solutions typically involve pulling off-chain data and making it available on-chain for smart contract verification. However, they face several limitations:

Cost: Existing PoR solutions are often expensive to implement, making it challenging for smaller exchanges and protocols to adopt them. This high cost barrier limits widespread use across the industry.

Limited blockchain integration: Many current solutions are primarily designed to work with specific blockchain networks, such as those compatible with the Ethereum Virtual Machine (EVM). This limitation restricts their applicability to a broader range of blockchain ecosystems.

Complexity: Implementing these solutions can be technically complex, requiring significant resources and expertise.

Third-party reliance: Most current offerings are provided via third parties, introducing an additional layer of trust. This goes against the trustless principles that blockchain technology aims to achieve.

These challenges highlight the need for more accessible, cost-effective, and versatile PoR solutions that can cater to a wider range of blockchain networks and service providers in the industry.

The Future of Proof of Reserves

As the industry evolves, there's a clear need for more accessible and cost-effective real-time PoR solutions. The ideal future system would:

Provide real-time or near-real-time verification

Be affordable for both large and small companies

Offer easy integration with existing systems

Scale effectively to handle the growing crypto market

Implement a trustless setup, eliminating the need to rely on third parties for verification

Core Technological Components of Proof of Reserves

To understand how real-time POR works, it's important to grasp some of the key technological components that make it possible. The core components are essentially Merkle Trees and Zero-Knowledge Proofs (ZKPs). The idea behind building such cryptographic proofs is a really interesting one and goes back to as early a 2014 (worth reading the proposal on the Bitcointalk forum). An idea was proposed to use a Merkle tree-based technique to verify whether certain sites really hold the bitcoins they claim to hold. So it was already a point of attention at that time.

Merkle Trees

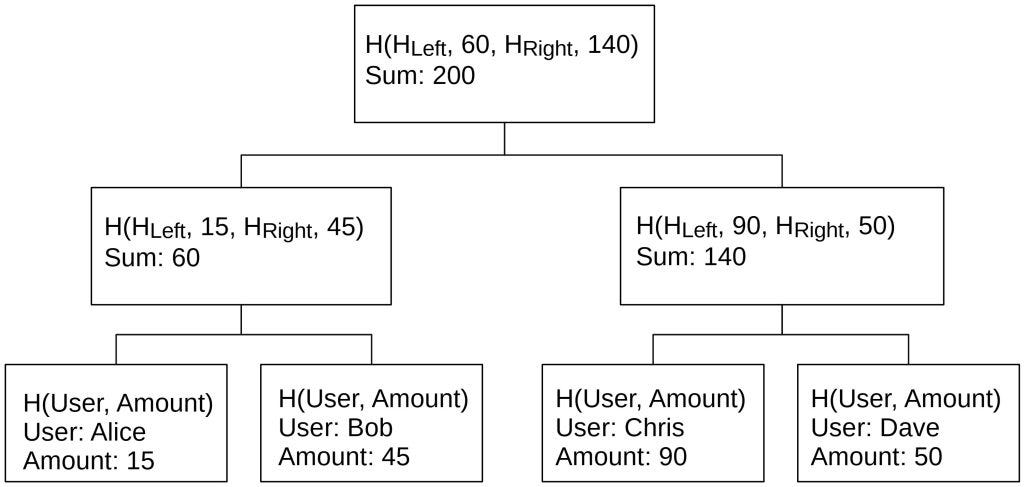

So what are those ‘Merkle tree-based techniques’ where (self declared) Cyberpunk Greg Maxwell was referring to in 2014? Merkle trees are a fundamental data structure in cryptography and blockchain technology. They allow for efficient and secure verification of large data sets. In the context of POR (specifically for exchanges), a variant of the Merkle Tree is often used called a Merkle Sum Tree. In such a tree, leaves are one-way hashes of user account private data.

The Merkle Sum Tree works as follows:

Each leaf node contains a hash of a user's account data (e.g., account ID, balance) and the actual balance value.

As we move up the tree, each parent node contains: a) A hash of its child nodes' hashes b) The sum of its child nodes' balances

This structure allows for two critical features:

Efficient verification of individual account inclusion (through Merkle proofs)

Verification of the total sum of all account balances

The root of the Merkle Sum Tree represents both the cryptographic proof of all included accounts and the total sum of all balances. This allows exchanges to prove they have sufficient reserves to cover all user balances without revealing individual account details.

However, this approach faces a privacy challenge: to verify a proof in a summation tree, one needs to know the balances of neighboring nodes. This is where Zero-Knowledge Proofs come into play.

Zero-Knowledge Proofs

Zero-Knowledge Proofs (ZKPs) are cryptographic protocols that allow one party (the prover) to prove to another party (the verifier) that a statement is true without revealing any information beyond the validity of the statement itself.

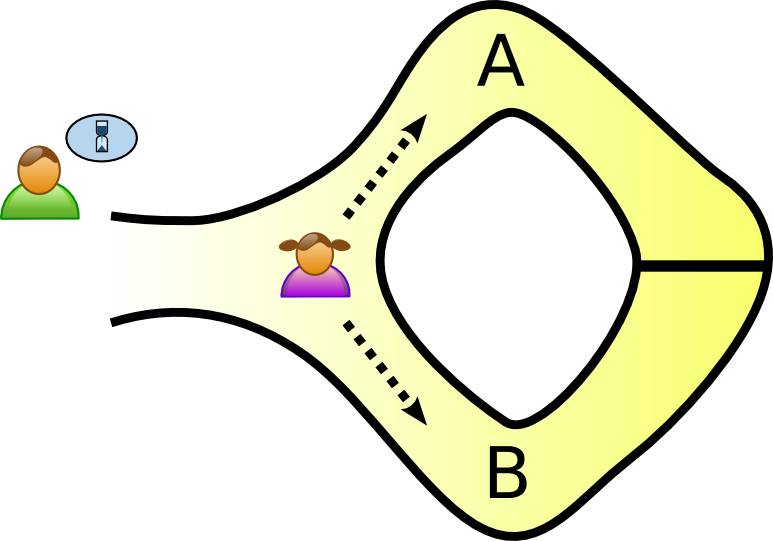

The Famous Cave Diagram above illustrates a simple Zero-Knowledge Proof:

Peggy (purple figure) claims to know a secret password that opens the magic door between paths A and B.

Victor (green figure) wants to verify this without learning the password.

The process:

Peggy enters the cave, choosing path A or B randomly.

Victor shouts to Peggy that he should take back path A or B.

Peggy must exit from the called path, using the door if necessary.

Repeating this many times, Victor becomes convinced Peggy knows the password without learning it himself. This demonstrates ZKP's core principles:

Completeness: Peggy can always convince Victor if he knows the password.

Soundness: Peggy can't trick Victor if she doesn't know it.

Zero-knowledge: Victor learns nothing about the password itself.

In the context of POR, ZKPs address the privacy concerns raised by Merkle Sum Trees. Instead of users directly validating their Merkle Proof by hashing their private data and rebuilding the root hash (which would require knowledge of other users' balances), they can validate a ZKP that's validating their Merkle Proof.

Here's how ZKPs enhance the POR process:

The exchange generates a ZKP for each user's Merkle proof.

This ZKP proves that: a) The user's account is included in the Merkle Sum Tree b) The user's balance is correctly incorporated in the tree's total sum c) All balance values in the path are non-negative

Users can verify this ZKP without learning anything about other accounts or the specific path their account takes in the Merkle Sum Tree.

By combining Merkle Sum Trees with ZKPs, exchanges can provide a robust POR that:

Proves the total sum of user balances

Allows individual users to verify their account inclusion

Maintains privacy for all users

Prevents manipulation of reported balances

This approach significantly enhances the trustworthiness and transparency of crypto exchanges and protocols, addressing many of the concerns raised by recent platform collapses.

E7.2: Building a More Trustworthy Ecosystem With Accountable Proof of Reserves

POR is a crucial tool for ensuring transparency in the crypto ecosystem, but the current model of infrequent reporting falls short of the needs of a fast-moving market. As we move forward, real-time PoR should become the industry standard—not just for compliance, but for securing the future of the entire crypto space.

But what if we told you that the future is already here?

At Accountable, we've developed a state-of-the-art system that combines real-time data aggregation, advanced cryptography, and automated auditing processes to deliver a comprehensive and continuously updated Proof of Reserves solution - all in a trustless way.

Next week, together with CTO Ioan Moldovan, we're pulling back the curtain on a our solution that's set to redefine how we approach PoR. In doing so, we're working towards a more trustworthy, transparent, and efficient financial ecosystem.

Thanks for reading and see u next week!

Keep building 🛠

Michiel